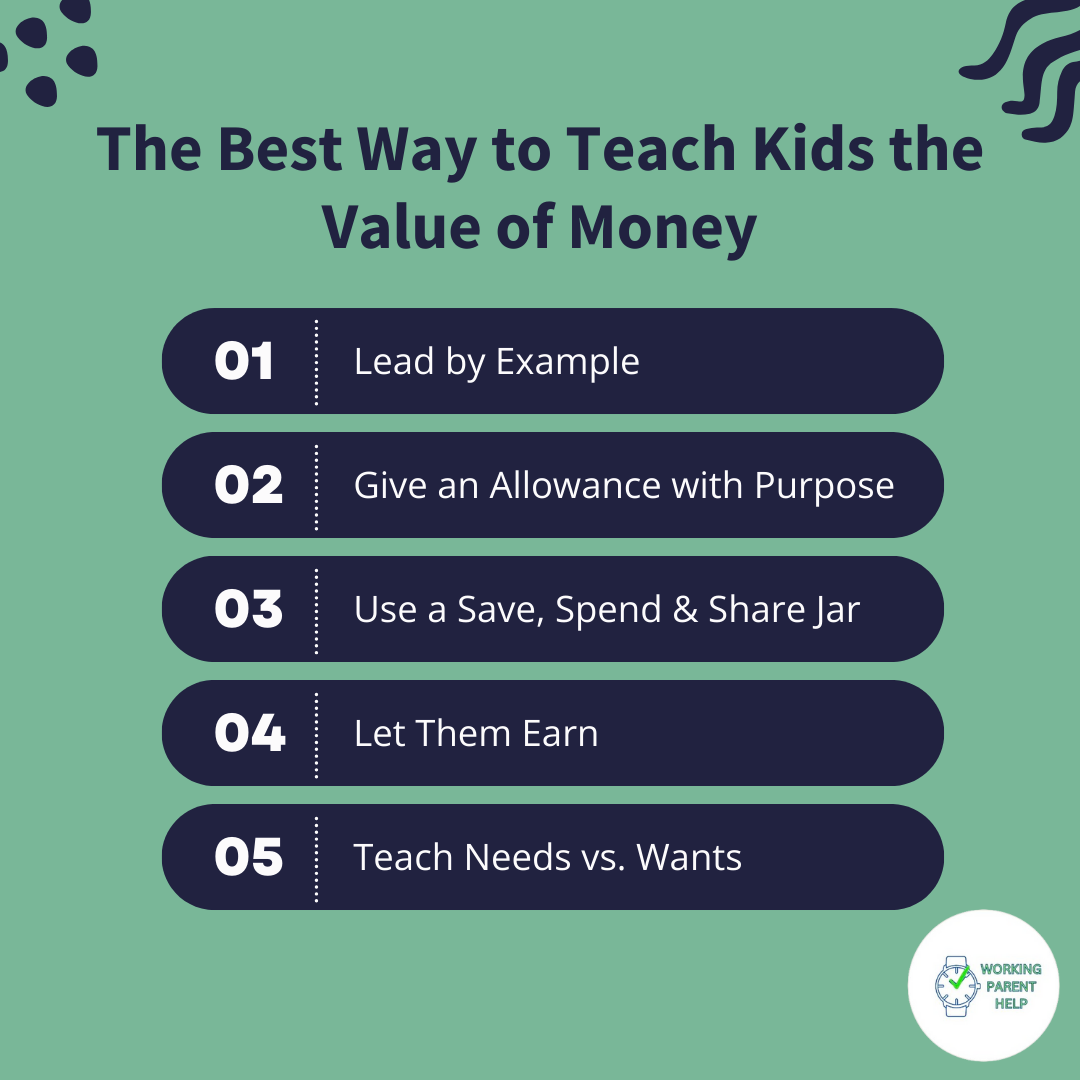

The Best Way to Teach Kids the Value of Money

As parents, we all want our kids to understand the value of money. After all, we don’t want them thinking that ATM machines magically produce cash like a never-ending candy dispenser. Teaching financial responsibility early can help kids grow into adults who know how to budget, save, and spend wisely (unlike that one friend who still believes credit cards are free money).

But how do you teach money smarts to kids when they think “budgeting” is just a fancy way of saying "let's not get ice cream"? Fear not, busy parents! Here’s a guide to making money lessons fun, engaging, and effective.

1. Lead by Example

Let’s be honest—kids are like little financial detectives. They notice when you say, “We can’t afford that toy,” and then five minutes later, you order overpriced coffee. If we want to teach them smart money habits, we have to walk the talk.

When you’re at the store, explain why you’re choosing a generic brand over a name brand or why you’re waiting for a sale instead of buying impulsively. If they see you budgeting, saving, and making thoughtful spending choices, they’ll start to pick up on these habits themselves. And hey, maybe they’ll even start questioning their own impulse purchases—like that slime kit they just had to have (only for it to end up stuck to the carpet three days later).

2. Give an Allowance with Purpose

Giving kids an allowance can be a great way to teach them about managing money. But instead of just handing it over like an endless paycheck, tie it to small responsibilities.

For younger kids, their “jobs” can be simple, like setting the table or feeding the pet. Older kids can take on bigger tasks like helping with yard work or organizing their room (which, let’s be real, may require some serious motivational speeches).

When kids earn their own money, they start to understand the effort behind every dollar. Suddenly, spending $10 on a fidget toy doesn’t seem like the best use of their hard-earned cash. Welcome to financial enlightenment, kiddos!

3. Use a Save, Spend & Share Jar

Instead of letting your child spend their allowance as soon as they get it, introduce a simple three-jar system:

-

Save: This is for bigger purchases down the line (like that LEGO set they keep drooling over).

-

Spend: This is their fun money for immediate wants.

-

Share: This goes toward charity, helping a friend, or a good cause.

This method teaches kids balance. They learn patience through saving, responsibility through spending wisely, and generosity through sharing. Plus, it’s a great way to avoid the classic “Can I have more money?” speech every time you walk into a store.

4. Let Them Earn

If kids want extra money for something beyond their allowance, give them opportunities to earn it. Think of age-appropriate tasks that go beyond their usual household responsibilities.

For example, they could wash the car, help with meal prep, or do a mini “garage sale” by selling old toys or clothes. This helps them connect work with income—a crucial life lesson (because let’s face it, we’d all love free money, but reality says otherwise).

Encourage them to set a goal for a special purchase, then help them track their progress. Not only will they learn to work toward something, but they’ll also feel the joy of finally buying that long-awaited item with their own money. It’s like watching a budgeting guru in the making!

5. Teach Needs vs. Wants

It’s not easy explaining to a five-year-old why a new toy isn’t as important as groceries, but it’s a crucial lesson. Start by breaking it down into simple terms:

-

Needs: Things we must have to live (food, clothes, a place to live, WiFi… okay, maybe not that last one, but try telling that to a teenager!).

-

Wants: Things that are nice to have but aren’t essential (the latest sneakers, toys, or yet another stuffed animal).

When you’re shopping, turn it into a game. Ask your child to point out whether an item is a “need” or a “want.” This will help them develop better decision-making skills when it comes to spending their own money. Plus, it might just stop them from asking for a candy bar at checkout every single time (fingers crossed).

Final Thoughts: Make Money Lessons Fun!

Teaching kids about money doesn’t have to be a chore. Turn it into a fun, ongoing conversation. Play “store” at home where they “buy” things with pretend money. Let them help with grocery shopping by giving them a small budget for snacks. Watch kid-friendly videos or read books that introduce money concepts in a fun way.

By incorporating these lessons into everyday life, your child will develop money smarts that will serve them well into adulthood. And who knows? Maybe one day, they’ll be the one reminding you to budget (talk about a full-circle moment!).

What’s the funniest money-related conversation you’ve had with your child? Share your story in the comments below or check out our other blog posts for more parenting tips!